New Development Law

Development Law 4887/2022 (Official Gazette 16/A/4-2-2022)

Purpose

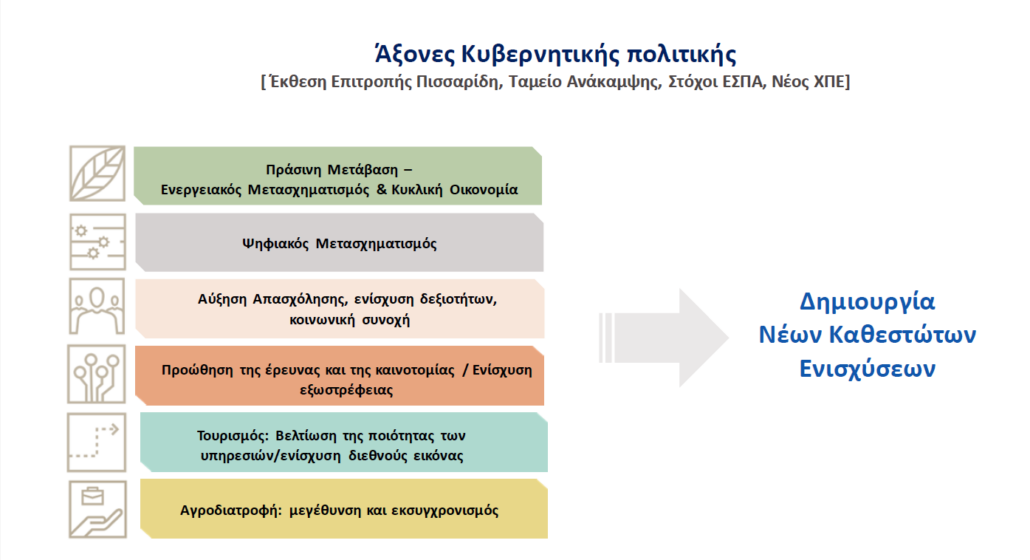

The purpose of the new Development Law 4887/2022 (article 1), is to promote the economic development of the Country by granting incentives to specific activities and sectors, in order to achieve the digital and technological transformation of businesses, the green transition, the creation of economies of scale , the support of innovative investments and those seeking the introduction of new technologies of "Industry 4.0", robotics and artificial intelligence, the strengthening of employment with specialized personnel, the support of new entrepreneurship, the strengthening of less favored areas of the country and areas that are included in the Just Development Transition Plan (Just Development Transition Plan), the further strengthening of tourism and the improvement of competitiveness in sectors of high added value.

It will work in conjunction with the Recovery Fund

The development law is harmonized with the Development Plan for the Greek economy, the Report of the Pissarides Committee, the National Recovery and Resilience Plan Greece 2.0, the goals of the NSRF 2021-2027, industry 4.0 and of course the new Regional Aid Charter, the which gives special support to the regions.

The new Development Law establishes 13 regimes for granting state aid to investment projects. It foresees specific amounts for each thematic regime, enhanced percentages for the investments to be implemented in the regions of the Just Development Transition.

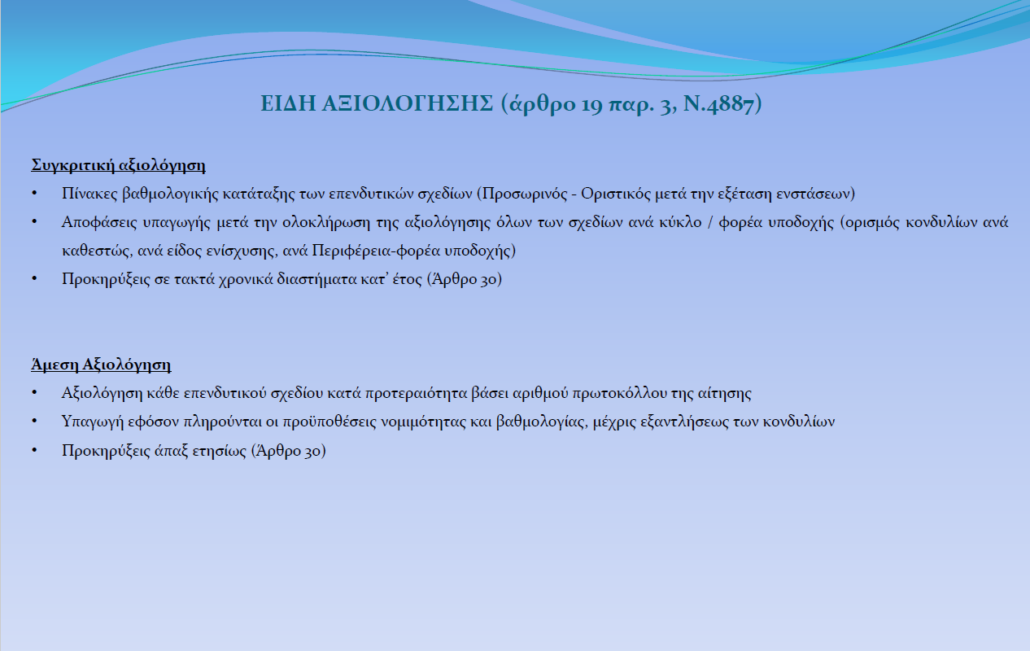

13 thematic aid schemes: (Direct evaluation 1,2,4,5,11,12, Comparative evaluation 3,6,7,8,9,10,13 )

- Digital and technological transformation of businesses,

- Green transition – Environmental upgrading of businesses,

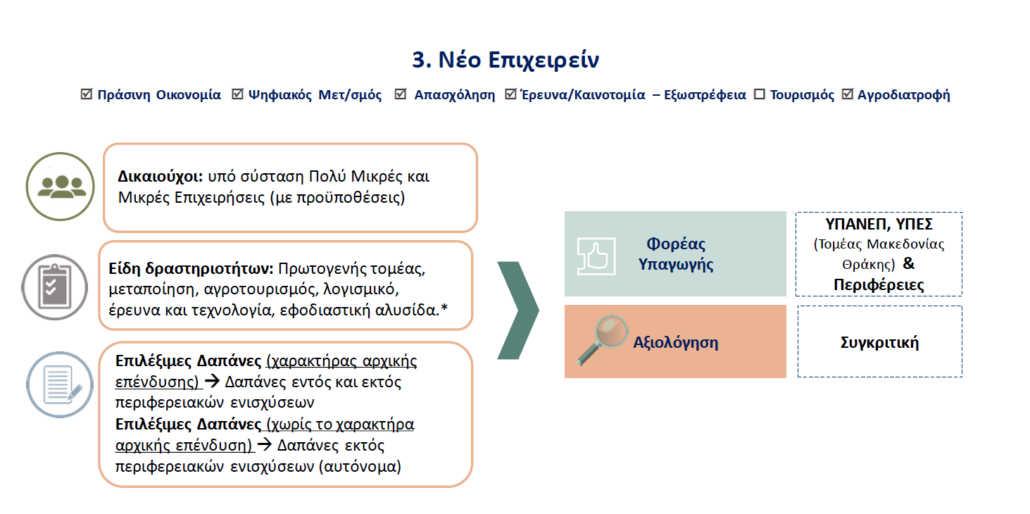

- New Business,

- Just Development Transition Regime,

- Research and applied innovation,

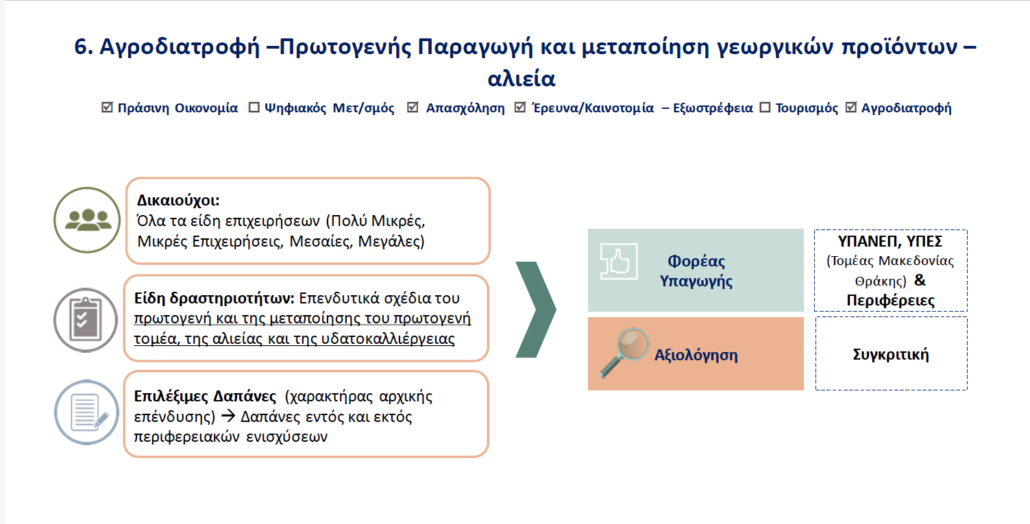

- Agri-food – primary production and processing of agricultural products – fisheries and aquaculture,

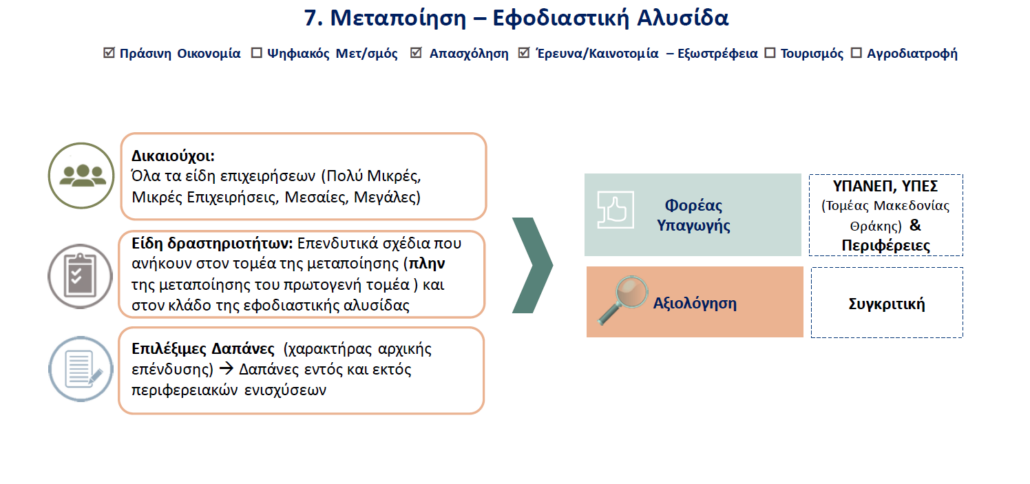

- Manufacturing – Supply Chain,

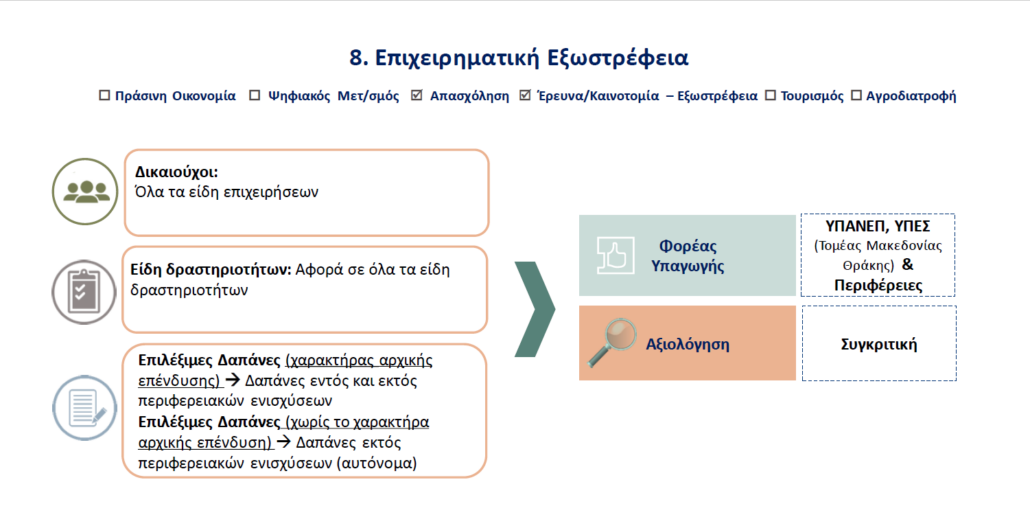

- Business extroversion,

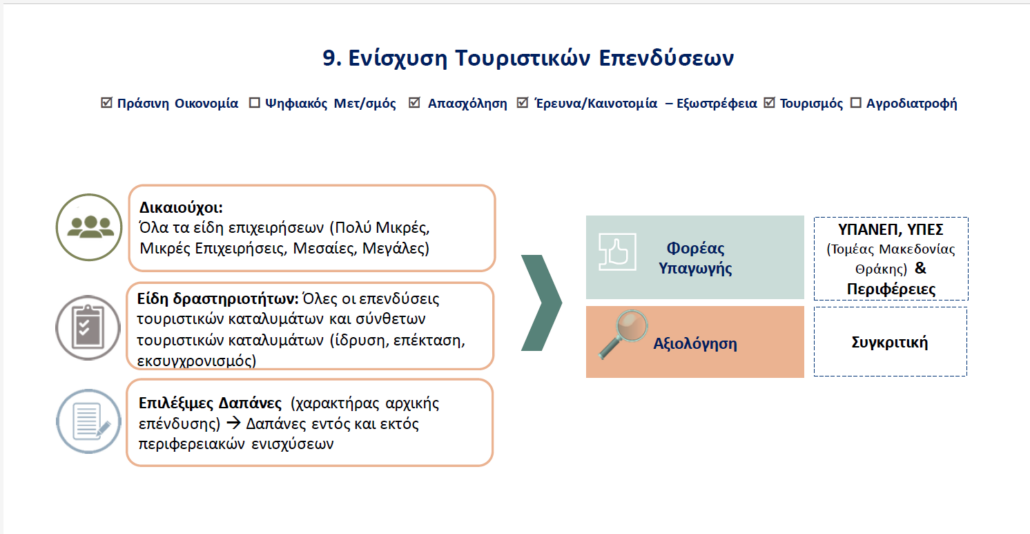

- Strengthening tourism investments,

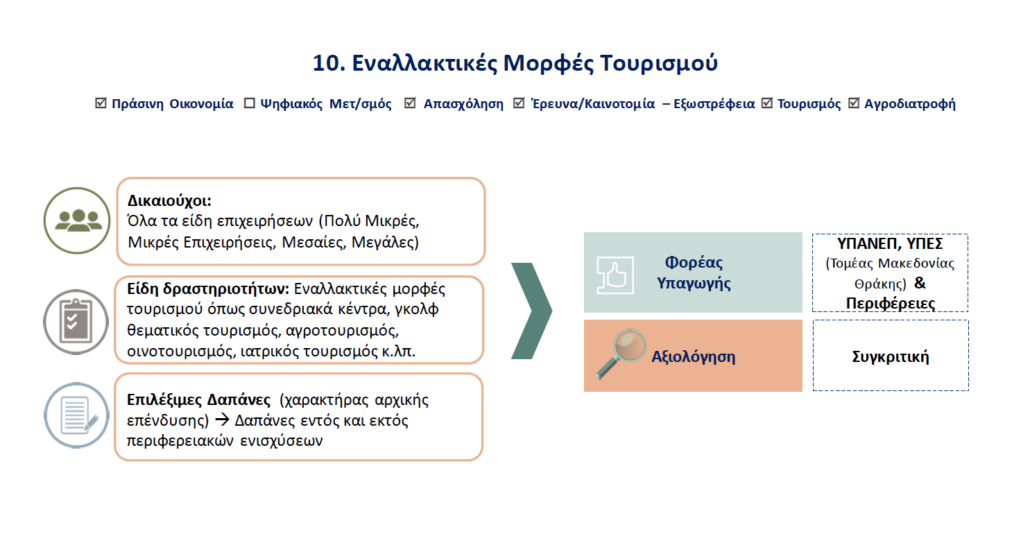

- Alternative forms of tourism,

- large investments,

- European value chains,

- Entrepreneurship 360ο.

The state aid schemes which are planned to be implemented by Region of Central Greece, concern investment projects of an eligible amount of up to one million (1.000.000) euros, which are implemented within the boundaries of the Region and are submitted to Department of Development Planning of the Region, is:

(Comparative assessment)

- NEW BUSINESS

- AGRICULTURE – PRIMARY PRODUCTION AND PROCESSING OF AGRICULTURAL PRODUCTS-FISHERIES

- PROCESSING – SUPPLY CHAIN

- business extroversion

- REINFORCEMENT OF TOURIST INVESTMENTS

- ALTERNATIVE FORMS OF TOURISM

- ENTREPRENEURSHIP 360º.

Types of Reinforcements

a. Tax Exemption

b. Subsidy

c. Leasing subsidy

d. Subsidizing the cost of the employment created

e. Venture financing (only for New Business status).

Intensity of Reinforcements

According to the approved Regional Aid Chart, the maximum aid intensities for the Region of Central Greece can rise:

- 60% for micro and small businesses (40% +20%)

- 50% for medium enterprises (40% +10%)

- 40% for large companies

Depending on the scheme, +20% may be granted for areas affected by natural disasters, mountainous areas.

Hosts

Applications for inclusion in the development law 4887/2022 for the granting of aid are submitted as follows:

- In the Directorate of Development Planning (DIAP) of the Region, the eligible investment projects of up to one million euros (€1.000.000), which are implemented within the boundaries of the Region of Central Greece

- In the General Directorate of Private Investments of the General Secretariat of Private Investments and Public-Private Sector Partnerships (S.D.I.T.) of the Ministry of Development and Investments the remaining investment plans.

Eligible bodies of the New Development Law

In order to be able to submit an application to the development law, companies must be established or have a branch in Greece at the start of the investment project and have one of the following forms:

- Commercial company

- Partnership

- Social cooperative enterprises

- Agricultural and Urban cooperatives

- Producer Groups and Organizations

- Agricultural partnerships of Law 4384/2016

- Public, Municipal Enterprises and their subsidiaries under conditions

- Sole proprietorships only in the "Agrifood-primary production and processing of agricultural products-fishing and aquaculture" regime with a maximum eligible cost of €200.000.

- Companies under incorporation or merger, provided they have completed publicity procedures prior to submission of the proposal.

Minimum amount of investment projects:

- In order to be included in the regimes, the existence of a minimum amount of the eligible cost of the investment project is required, which is determined based on the size of the organization, and specifically amounts to:

- an amount of one million (1.000.000) euros for large companies,

- an amount of five hundred thousand (500.000) euros for medium-sized enterprises,

- an amount of two hundred and fifty thousand (250.000) euros for small businesses,

- an amount of one hundred thousand (100.000) euros for very small businesses,

- an amount of fifty thousand (50.000) euros for Social Cooperative Enterprises (SOEs), Agricultural Cooperatives (AS), Urban Cooperatives, Producer Groups (O.P) and Agricultural Corporate Partnerships (A.E. .S.).

Investment plan content

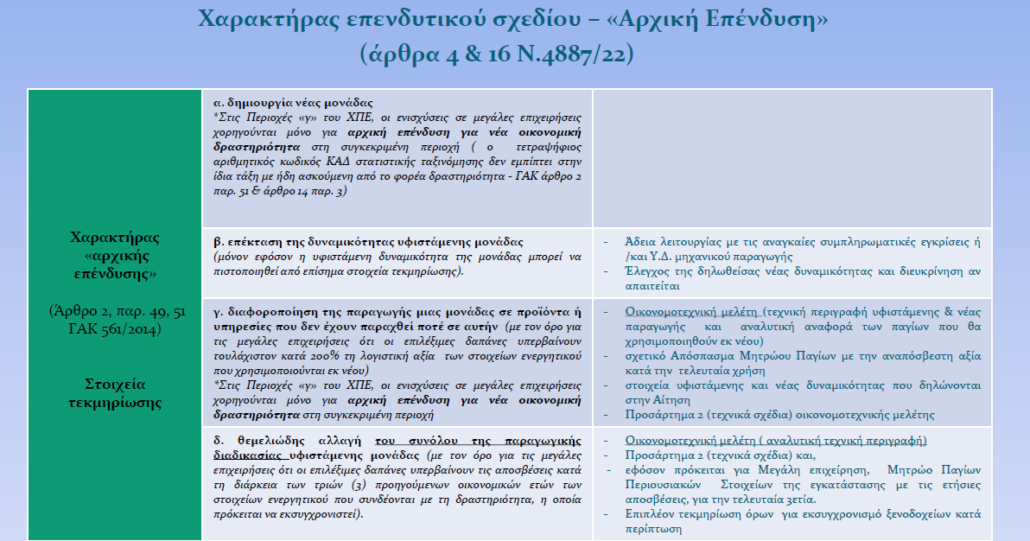

Investment projects for regional aid, which are subject to the aid schemes herein, must have an integrated nature of initial investment and in particular meet one of the following conditions:

- Create a new unit

- Capacity expansion of an existing unit

- Diversification of a unit's output into products that have never been produced or services that have not been provided by it. provided that the aided expenses exceed by two hundred percent (200%) at least the accounting value of the assets that are reused, as this value has been recorded in the tax year preceding the application for inclusion of the investment project.

- Fundamental change of the entire production process of an existing unit. On large enterprises, it is also required that the aided investment expenses exceed the depreciation of the assets, which are related to the activity to be modernized and occurred during the three (3) previous tax years. If the depreciation associated with the activity is not clearly recorded, it is considered that the above condition is not met.

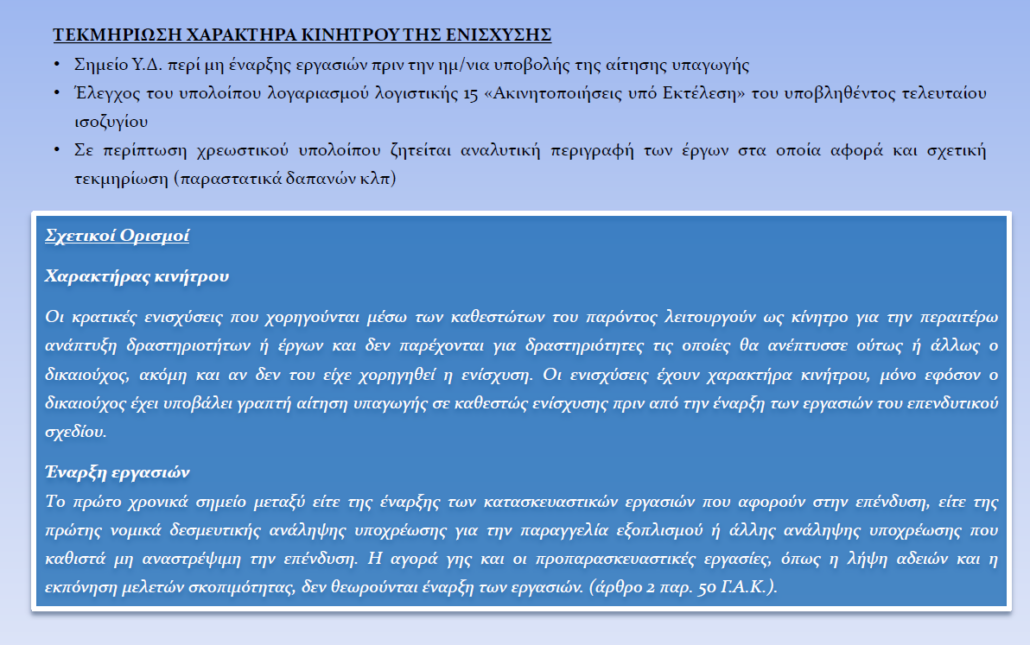

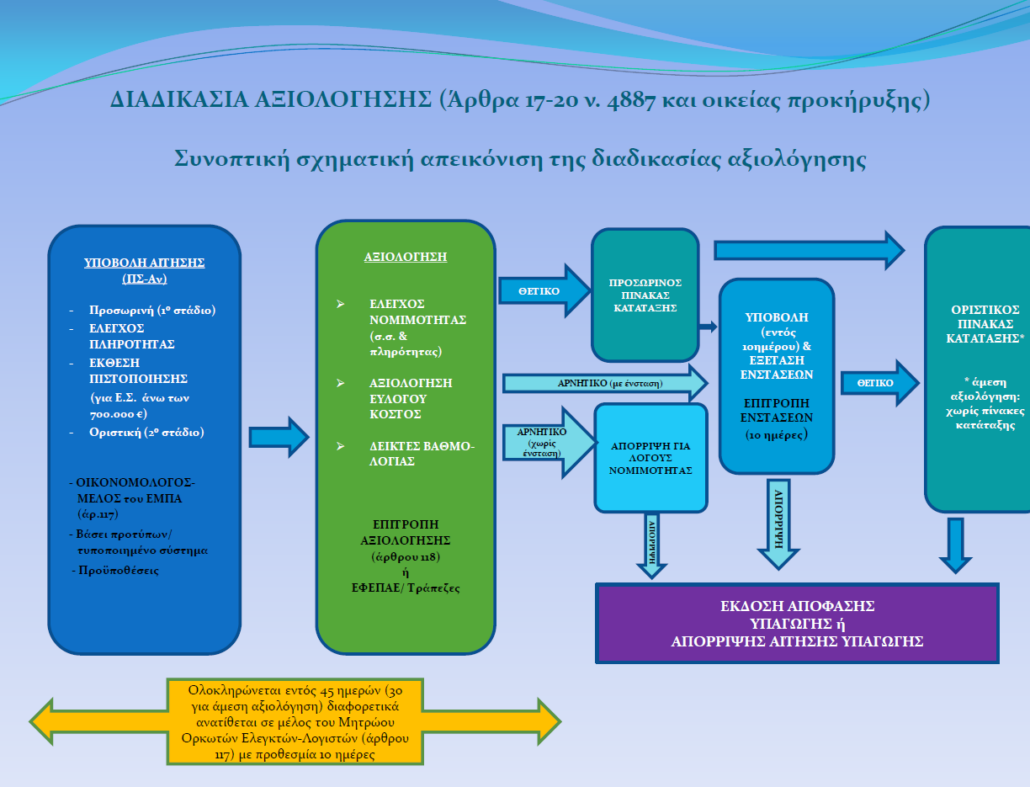

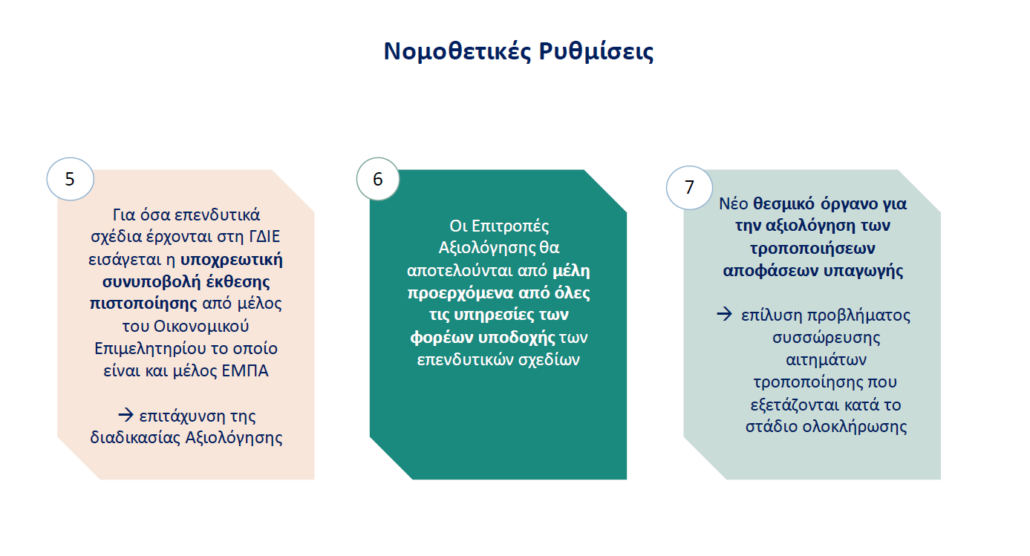

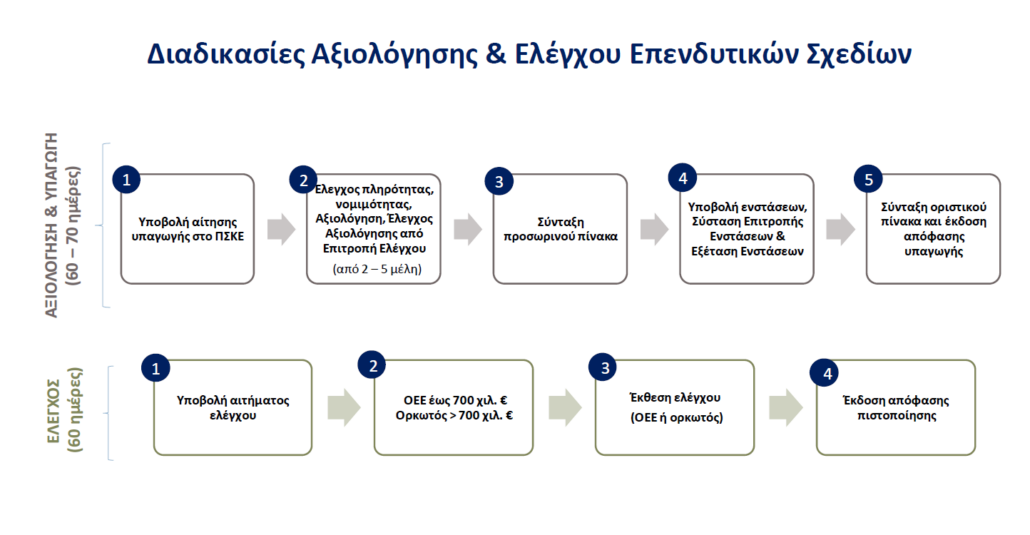

Arrangements for Assessment and Control procedures

The new development law results in an acceleration of procedures, without delay in the inclusion and completion of business plans.

The audit of investment plans in the amount of more than seven hundred thousand (700.000) euros is carried out by a sworn auditor - accountant or audit firm) and under the amount of seven hundred thousand (700.000) euros, it is carried out either by an authorized audit body, which is constituted by members of the National Register of Certified Auditors (E.M.P.E.), either by a sworn auditor-accountant or an auditing firm.

Map of Regional Aids

The General Secretariat of Private Investments and Public-Private Sector Partnerships (GIE & PPP) is subordinate to the Ministry of Development and Investments and is responsible for the planning and implementation of Development Laws, Strategic Investments and Public-Private Sector Partnerships. It consists of two General Directorates, the General Directorate of Development Laws and Foreign Direct Investments and the General Directorate of Strategic Investments, as well as the Public-Private Sector Partnerships Unit.

The mission of GIE & PPP is the implementation of government policy to facilitate and strengthen private (national and foreign) investments and public-private partnerships to stimulate the national economy.

The primary goal and challenge is the attraction and implementation of private investments as well as the improvement of the investment environment through reforms to speed up and simplify the prescribed procedures.

With the new institutional framework of strategic investments (law 4864/2021), the Just Development Transition (law 4872/2021) and the new Development Law (law 4887/2022) for private investments, a complete, attractive, flexible and effective investment climate which will bring significant benefits to the national and local economy.

In addition, PPP projects are an important development tool of partnership between the public and private sectors for the execution of projects and/or the provision of services, with multiplier benefits for local communities and the State.

Institutional framework

Laws

- Law 4887/2022 "Development Law - Greece Strong Development" (Government Gazette 16/A/4.2.2022)

- N. 4914/2022 "Management, control and implementation of development interventions for the Programming Period 2021-2027, establishment of a Public Company "National Register of Young Enterprises S.A." and other provisions. (Government Gazette 61/Α΄/21.3.2022), articles 78-82, 85

- Law 4949/2022 "Incorporation of par. 5 of article 1 of Directive (EU) 2017/952..." (Official Gazette 126/A/30.6.2022), articles 71-73

- General Exemption Regulation no. 651 of the Commission of 17 June 2014 (L 187/1 26-6-2014)

- N. 4609/2019 (Government Gazette 67/A'/3.5.2019), article 58: Control of investment plans of laws 4399/2016 and 3908/2011

- Law 4399/2016 "Institutional framework for the establishment of Private Investment Support schemes for the regional and economic development of the country - Establishment of a Development Council and other provisions". (Official Gazette 117/A΄/22.6.2016

Ministerial decisions

- WILL. 91631/26.9.2022 (Government Gazette 5026/B/26.9.2022)) "Assignment of the Evaluation of Investment Plans of Development Law 4887/2022 to the "Intermediate Agency for Operational Programs of Competitiveness and Entrepreneurship" (EFEPAE)

- KYA 77876/2.8.2022 (Government Gazette 4136/B/3.8.2022) "Definition of areas of the Territory where the aid of Law 4887/2022 does not apply to investment projects in the tourism sector".

Institutional framework of the General Secretariat of Private Investments

Announcements

- Issuance of a temporary ranking table of investment projects submitted for inclusion in the "Processing-Supply Chain" aid scheme in the Region of Central Greece

- The 2nd round of applications for the inclusion of investment projects for the aid scheme "Strengthening Tourism Investments" of the Development Law 4887/2022 is underway

- The 2nd round of applications for the inclusion of investment projects for the "Processing - Supply Chain" aid scheme of the Development Law 4887/2022 is underway

Proclamations

Open Tenders

Notices by aid scheme

Processing - Supply Chain - Law 4887/2022

Circle 2

Circle 1

Strengthening Tourism Investments - Law 4887/2022

Circle 2

Circle 1

Entrepreneurship 360 – Law 4887/2022

Circle 1

- WILL. 33767/10.4.2023 (Government Gazette 2311/B/10.4.2023) "Amendment of under no. 126997/28-12-2022 of ministerial decision "Proclamation of the "Entrepreneurship 360" Support Scheme of the Development Law 4887/2022" (B' 6872)"

- WILL. 126997/28.12.2022 (Government Gazette 6872/B/29.12.2022) "Proclamation of the "Entrepreneurship 360" Support Scheme of the Development Law 4887/2022"

Agri-food - Primary Production and Processing of Agricultural Products - Fisheries - Law 4887/2022

Circle 1

Decisions on affiliation - modification

Contact

DIRECTORATE OF DEVELOPMENT PROGRAMMING

(Email:danapprog@pste.gov.gr)

The Department of Regional Development Incentives is responsible in particular for:

- The cooperation with regional bodies for the drafting and submission of proposals for the implementation of projects, financed by programs, in the framework of the European Territorial Cooperation objective.

- The establishment of the Regional Advisory Committee, which provides opinions on applications for investment or equipment leasing programs, in accordance with current legislation.

- The exercise of the responsibilities and obligations of an Intermediate Management Body for private investment operations that are included in operational programs, which are co-financed by European Union resources.

- The receipt of applications for inclusion of investments, the control of the data, their evaluation, the recommendation to the Regional Advisory Committee, the issuance of the decision of inclusion, the decisions of modification and the monitoring of the implementation of the investment plan, the withdrawal of inclusion and the return of aid that has been paid, according to current legislation.

- The formation of the Regional Investment Control Bodies for the certification of the expenses and the implementation of the approved works, in accordance with the current legislation.

- The payment of the investment cost grant and the completion and certification of the start of production.

- The recording of the new jobs created by the implementation of the approved investments.

- The formulation of policy proposals and measures for the development of small and medium enterprises to the competent Ministry.

- Information and assistance to small and medium-sized businesses at a sectoral or other level, with the aim of developing their business capacity and competitiveness.

- Monitoring and pointing out to the competent bodies issues that refer to the taking of the necessary measures to improve the standard of living of the citizens.

- The opinion on any matter of local or wider interest, for which an opinion is requested.

| DEPARTMENT | FULL NAME | PHONE | |

|---|---|---|---|

| Regional Development Incentives | Kalisiakis Grigorios (Deputy Head of Department) | 2231354815 | gr.kalisiakis@pste.gov.gr |

| Cappos George | 2231352623 | g.kappos@pste.gov.gr | |

| Bartsioka Hara | 2231352630 | h.mpartsioka@pste.gov.gr |